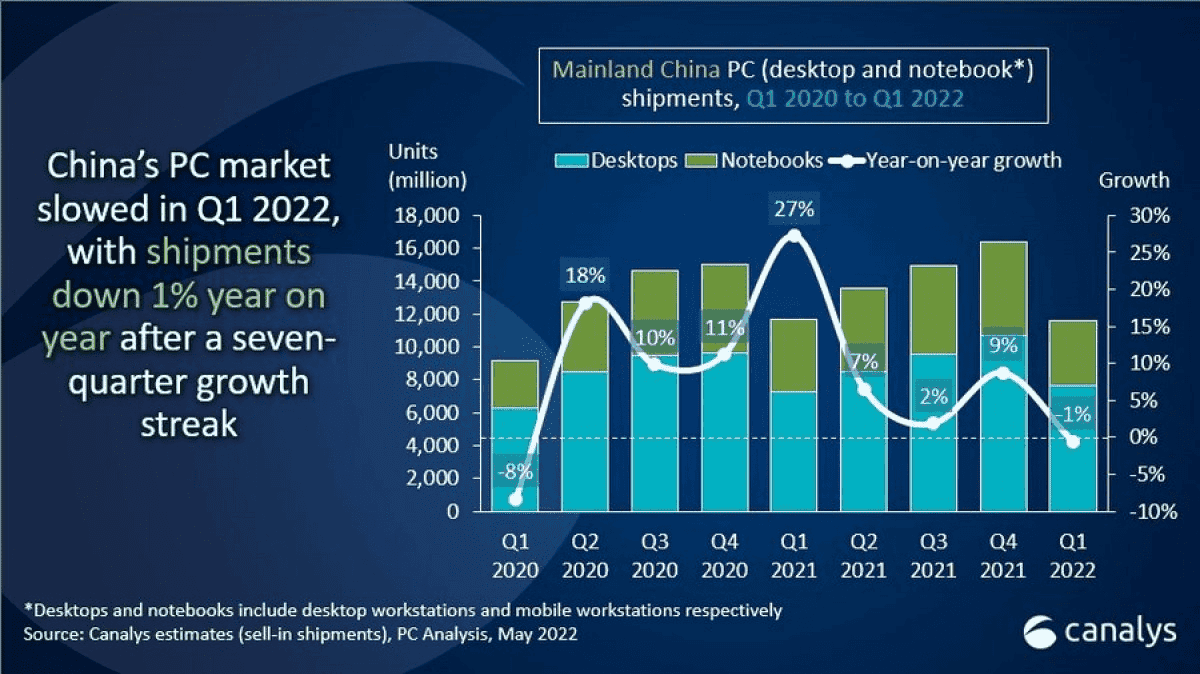

Recent reports have been suggesting a drop in the PC segment recently. In fact, many motherboard manufacturers are expecting a huge drop in orders due to the low demand. The hopes are in the next set of products coming from big companies such as AMD, Intel, and NVIDIA. However, we can already see a big decline in the overall consumer market. According to a recent report made by Canalys, the desktop, notebook, and workstation market in China amounted to 11.66 billion combined shipments for the first quarter of 2022. That is a slight decline in China's PC market from the 11.75 million experience a year ago, according to Canalys.

Lenovo remains the leader of China PC market

As expected, Lenovo remains the market leader for another round. The company has successfully shipped around 4.29 million units of computers, notebooks, and workstations. Therefore, the company currently stands with a 37 percent slice of the market. Lenovo has been the king of the PC market for a while, and apparently, there is still nothing capable of hurting its domain in the PC segment. The North-American manufacturer, Dell, was the second with 1.39 million which results in a total market share of around 12 percent. Finally, we have the legendary HP in the third position. The company sold nearly 0.97 million PCs amassing an 8 percent market share.

Asus also appears in the account with 0.83 million. Huawei also appears in the report with 0.71 million. These five companies compose the top five. The Desktop sales fared even worse with an 11 percent annual drop down to 3.9 million units. The notebooks were the only product category to see significant growth with 7.7 million combined units and a 6 percent market share.

Apparently, China's PC Market results were affected by the COVID-19 wave in China. The recent surge of cases made the country adopt severe measures and a new lockdown. As a result, this has stressed the manufacturing and also the demand. As a result, the supply chains are yet again going through another constraint with component shortages affecting the entire market. This has been rising inflation and resulting in weaker demand. After all, the purchasing power of customers is declining.

The lockdowns in China are also affecting other departments in the industry. For example, the iPhone 14 series launch is threatened by the components shortage.

The tablet segment also sees a decline

The report also brings relevant information on tablets. Apparently. However, we have yet again another decline. The Chinese market saw another 13 percent decline in shipments as the demand momentum built up during the pandemic was lost. Apple was the leader of the segment with 1.2 million shipments. The Cupertino firm has a 26 percent market share. Huawei, despite all its limitations, comes in second with 0.93 million shipments and a 20 percent market share. Finally, we have Xiaomi that after a revival of its tablet segment managed to get into third place with 0.6 million shipments and a 13 percent market share. Honor is the only company that sees an improvement to 2 percent of market share and 0.4 million shipments. However, Honor wasn't much relevant in the last year. Moving on, Lenovo occupies fifth place with 0.3 million shipments and a 7 percent market share.

Place comments

0 Comments

You are currently seeing only the comments you are notified about, if you want to see all comments from this post, click the button below.

Show all comments