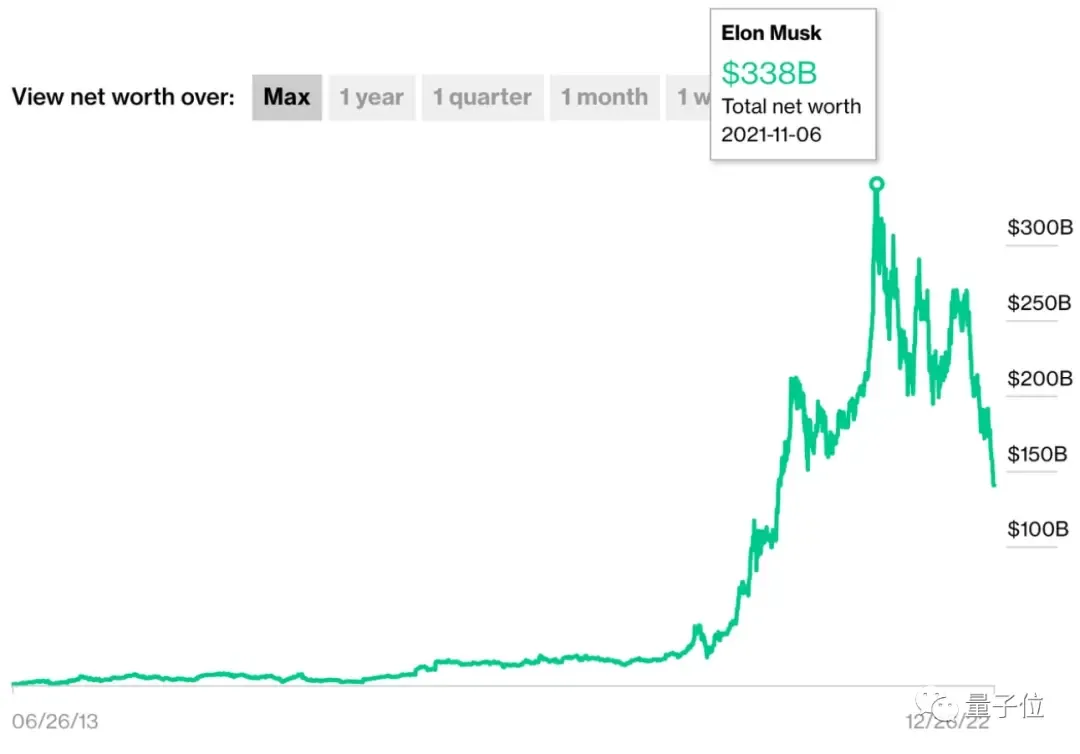

Twitter has been a tough nut for Elon Musk and it appears that it is even pulling him down. Since buying shares in January this year, proposing the acquisition in April, and officially acquiring in October, his net worth has plummeted along with the "Twitter drama", from $338 billion a year ago to $139 billion today. It directly fell by $200 billion US dollars.

This is not just a little less money, Elon Musk has no cash on hand. As Tesla's "unpaid employee", Musk's personal expenses and business investments rely on loans obtained by mortgaging Tesla shares. Now that Tesla's stock price is down, his situation will only become more difficult.

Not only has his financing ability been greatly reduced, but his previous method of making money by lending stocks has also become untrustworthy. If Musk could borrow $13 billion in April by mortgaging only 40% of Tesla's shares, now he has to mortgage all of his Tesla shares to borrow so much money. It will even further affect the debt situation of Twitter, which he operates. In other words, as Tesla's stock price leaked all the way, not only Musk's worth but also his capital turnover ability fell.

What is the impact of the price drop?

Let’s first take a look at the reasons for the decline in Musk’s worth. Tesla's stock price peaked in November last year, but it began to gradually decline after Musk began planning to buy Twitter. Last week alone, Tesla’s stock price fell by 18%. In 2022, the stock price will fall by about 65%, and its market value will plummet by about $700 billion.

In addition to Tesla's market value drop, Musk's net worth shrinks from $338 billion a year ago to $139 billion today. However, the impact of the decline in value on Musk is not just as simple as "less money". For one thing, Musk's ability to rely on Tesla's stock to raise capital quickly deteriorated as the stock price fell.

This is also related to Musk's investment habits. He himself does not hold a large amount of cash but sells or lends Tesla shares and "mortgages" them to banks in exchange for margin loans. At the same time, as the stock rises, he can further obtain more benefits. However, as Tesla's stock price fell, this routine of borrowing money did not work well.

Take the acquisition of Twitter, for example. After finalizing the acquisition of Twitter for $44 billion, Musk originally planned to use his old routine "mortgage shares" to complete the transaction. However, investors had some worries and did not approve of this approach. Thus, Elon Musk had to cancel the margin loan program and instead sell Tesla shares in exchange for more cash, cashing out about $39 billion in stocks.

Elon Musk had to bear debts

Due to Musk's low financing and borrowing ability, to acquire Twitter, he had to bear the debt. Elon Musk sold a batch of shares to pay taxes (about $11 billion) and cash for Twitter (about $25 billion). In addition, he also borrowed $13 billion from banks and raised investment funds (about $5.2 billion) from various places to finally complete the Twitter deal.

That's right, as Musk demolished Tesla's "Eastern Wall" to supplement the "West Wall", Twitter is exactly where he needs a lot of money. It is worth noting, however, that the bank's $13 billion loan was borne by Twitter. Previously, Musk’s bank consultant considered asking Musk to use the above margin loan method to lend a part of the stock to the bank in exchange for Twitter’s high debt.

As Musk's value fell, not only did the banks that lent money to Twitter prepare to include the money in loan losses, but Tesla's shares, which he originally planned to use to reduce Twitter's debt pressure, also became worthless. Twitter, by contrast, would add more than $1 billion in debt cost pressures annually.

Forced to adjust revenue forecasts

But the pressure on Twitter doesn't stop there. With Musk taking over, Twitter has gotten poorer. Unlike Musk’s tech companies, Twitter is a social network service platform. The main source of revenue is ads. At the same time, Musk, as the CEO of Tesla, made a lot of car advertisers afraid. Ford Motor, Audi America, Volkswagen and other car brands have successively reduced their ads on Twitter.

This also forced Musk to adjust Twitter’s revenue forecast again: the revenue target for the fourth quarter was lowered from $1.4 billion to $1.1 billion. Of course, Musk did not put all his eggs in one basket. He re-launched TwitterBlue on Twitter in an attempt to expand revenue sources. However, according to the New York Times, there are currently only 140,000 TwitterBlue accounts on Twitter, bringing in only $12 million in revenue. With the average user bringing in $5 billion a year in revenue, it's self-evident.

If this is not intuitive enough, in the previous data, according to Forbes, Twitter needs to have 64 million paying users to fully compensate for the existing ads and other losses. However, Twitter has less spending as its workforce is significantly lower

The CEO everyone wants to fire

From the perspective of financial issues, it is clear that Tesla and Twitter are already in dire straits. As the CEO of both companies, Musk began to be urged to "step down" by Tesla investors and Twitter users at the same time.

On the one hand, in the face of Tesla’s plunge, KoGuan Leo, the third natural shareholder, and even Ross Gerber, the shareholder who supported Musk’s acquisition of Twitter, said

It's time for Tesla to get a new CEO.

KoGuan Leo even said that he invested in Tesla because he was optimistic about Musk, but now he has abandoned it:

The stock price decline stops if someone takes over temporarily as CEO, which is what's happening now.

Unlike tech brands like SpaceX and Tesla, Twitter is a social media platform. Many investors are still worried about whether Musk can run the company well, and even think that Twitter affairs will drag down his success.

Place comments

0 Comments

You are currently seeing only the comments you are notified about, if you want to see all comments from this post, click the button below.

Show all comments