The iPhone 14 series is already in the market and it is doing quite well. At the moment, all attention has now shifted from the iPhone 14 series and we are now talking about the iPhone 15 series even though it will not launch until the fourth quarter of 2023. According to a recent report from DigiTimes, Apple’s iPhone 15 series will continue to use Qualcomm’s 5G modem (baseband chip). At the moment, Apple's 5G custom chips are still in development thus, it will continue to patronize Qualcomm.

Apple is currently working on an in house 5G modem designed to replace Qualcomm's Snapdragon 5G modem within the next few years. Today's report claims that TSMC will be Qualcomm's main supplier of 5G chips for the iPhone 15 series, using 5nm and 4nm processes. Apple iPhone 14 series uses the Qualcomm Snapdragon X65 modem, which helps improve 5G speed and battery life. According to the reports, the Apple iPhone 15 will use a more advanced Snapdragon X70 chip. This chip comes with AI functions that can increase the average speed, improve coverage, improve signal quality, reduce latency, and improve energy efficiency by up to 60%.

Previous reports claim that Apple would switch to an in-house 5G modem as soon as 2023. However, follow up reports suggest that Apple's 5G baseband chip development "failed". For this reason, Apple will continue to use Qualcomm modems in the near future. The iPhone 15 will bring several new features. A few weeks ago, popular Apple analyst, Ming-Chi Kuo reports that the iPhone 15 may likely adopt a "holeless" design. The "holeless" design refers to removing all the physical buttons on the iPhone and turning them into touch buttons. In order to make it have a real feel, it will also add vibrate feedback.

Largan prepares for Apple's iPhone 15

According to Taiwan Economic Daily, the iPhone 15 series is getting so much attention because of the huge expectations from the industry. The reports from the market reveal that the flagship model of the iPhone 15 series will come with a periscope lens for the first time. With this camera, Apple will also look for a way to make the device thinner and lighter. In addition, the company will also bring major upgrades to the camera capacity. Apple designated suppliers to use ALD atomic layer deposition coating equipment with an asking price of more than NT$100 million each.

According to market estimates, the total cost of ALD coating equipment purchased by Largan has exceeded the company's highest capital expenditure (NT$8.5 billion) over the years. Taiwan media points out that due to the long delivery time of the equipment and the fact that the equipment still needs to be verified, Largan placed an order to purchase the equipment last year and mastered the noise-resolving light (Flare) technology. In addition to the periscope telephoto lens, the two newly added prisms will also need to be coated in the future. Because Largan has mastered the tech and pioneered opportunities, it is expected to take all orders for new machine upgrade lenses.

According to the data, the new high of Largan’s capital expenditure was NT$8.5 billion in 2019. The outside world expects that with the arrival of ALD equipment, Largan's capital expenditure will be pushed to a new high.

5G baseband chip revenue in Q2 2022 will increase by 40% year-on-year (YoY)

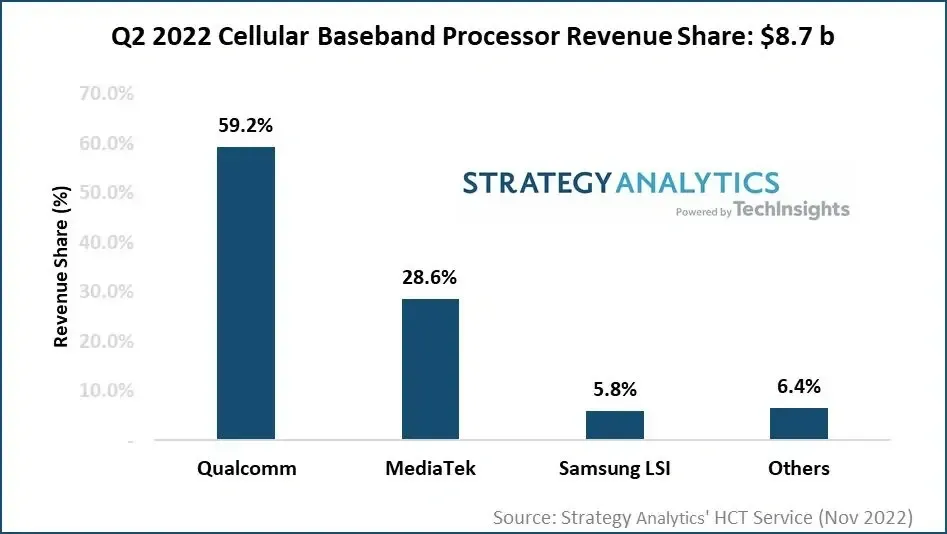

According to Strategy Analytics Handset Component Technology (HCT) Service Research Report "Baseband Market Share Tracking in the Second Quarter of 2022", the global cellular baseband chip market will grow by 19% in Q2 2022, reaching $8.7 billion. In the second quarter of 2022, 5G baseband chips revenue increased by 40% YoY. This is driven by the high end price segment while the mid range 5G baseband was hit due to inventory backlog.

Baseband revenues for both MediaTek and Qualcomm will shrink in the second half of 2022. This is mainly due to lower demand for mobile phones across price segments. Despite the weak market, the report believes that baseband brands need to implement pricing principles based on increasing foundry costs.

The report shows that Qualcomm and UNISOC have strong revenue growth. Qualcomm, MediaTek, Samsung LSI, UNISOC and Intel occupy the top five baseband market revenue shares in Q2 2022. Qualcomm led the baseband market with a 59% revenue share, followed by MediaTek with 29% and Samsung LSI with 6%. The 5G baseband revenue grew 40% YoY, while shipments rose 16%. Also, the mix of higher priced high end and high end 5G chips increases ASP (average selling price).

Strategy Analytics comments

Some analysts in strategy analytics also have their say with respect to the current market situation. An analyst said

“Qualcomm’s 5G base band revenue grew 53%, driven by a growing portfolio of high end and high end Snapdragon application chips. The company’s continued traction in the Samsung Galaxy S22 series will drive its baseband average prices lifted to another all time high. Despite strong products, Qualcomm will experience weakness in the second half of 2022. This is due to reduced demand in its core mobile phone chip market."

Another analyst said: "Driven by the increase in 5G share, MediaTek announced the highest baseband revenue in its history in Q2 2022. The company shifted its focus to the high end, but the revenue contribution from the high end is still low. MediaTek, like Qualcomm, baseband revenue will shrink in the second half of 2022 as customers (including Samsung, Xiaomi, OPPO, and Vivo) continue to adjust inventories. Despite the weak market setting, the report believes that base band suppliers need to exercise pricing principles given the increase in foundry costs."

Place comments

0 Comments

You are currently seeing only the comments you are notified about, if you want to see all comments from this post, click the button below.

Show all comments